", SPACs, CarbonLite Holdings and Another Awesome NOA. For junior folks,PETITIONis an educational tool that is -- in contrast to other dry and technical resources -- actually interesting and fun for them to read. What are the most effective investment opportunities in this market, from direct lending to mezzanine and distressed debt? Has the time come for more regulation in this market, particularly around fund leverage and liquidity risk management? Taking direct lending as an example, over the roughly 10 years since I first wrote about the growth of the strategy in Asia, the topic has been regularly recycled. To what extent is the potential for local currency swings an issue that indirectly impacts on private investments? To what extent has it matured to meet the risk and return profile of an increasingly sophisticated pool of global investors? LP Fireside Chat Harnessing the illiquidity premium of private markets. Market participants are closely monitoring credits such as Envision Healthcare and Incora for clues on whether legal challenges brought by lenders left out of priming recapitalizations can succeed. One-off 364-day offshore issuances supported by friends and family, backed by an SBLC and/ or a corporate guarantee, do get the job done and certainly bode well for those that can. Also in 2019, the Asian Development Bank estimated there was a $4.1 trillion funding gap for SMEs in the Asia region. The causes of the collapse in valuations are well documented and include exposure of vulnerabilities like liquidity mismatches leading to run dynamics and fire sales, and leveraged positions being unwound and amplifying price falls, according to the Bank of England. This lead was , Here's a little preview of today's subscribers'-only newsletter (dropping in ~30 min). Hear from market leading experts ondistressed restructuring,bankruptcy analysis, and the leveraged loan market in 2022 and beyond. Send Feedback to petition@petition11.com. 99 Cents Only and more While sources argue these have bottomed out, the question now is whether they will rebound fast enough to adequately support the financial needs of high beta names. Where are the key pockets of opportunity for private debt investors as the region recovers from the impact of Covid-19? As capital continues to move into this space and dry power increases, where are the pockets of opportunity opening up? As the markets in the US and Europe reach maturity, Asia is seen as a new avenue with massive potential for further growth. Their writers are a Breit bunch with a burning passion for the space, who Sea trends and Drill down on Hot Topics, it's the Tops. We accommodate group subscriptions. The video clips she shot on her phone while riding on the back of a delivery guys motorcycle en route to the train station showed deserted streets, clean but empty. Thread https://t.co/KGkLlMHRnB, Ive said it before and Ill say it again, if youre at all interested in disruption / restructuring / debt blowing up, you gotta read, I find it unnecessary to follow any other financial columns after reading.

", SPACs, CarbonLite Holdings and Another Awesome NOA. For junior folks,PETITIONis an educational tool that is -- in contrast to other dry and technical resources -- actually interesting and fun for them to read. What are the most effective investment opportunities in this market, from direct lending to mezzanine and distressed debt? Has the time come for more regulation in this market, particularly around fund leverage and liquidity risk management? Taking direct lending as an example, over the roughly 10 years since I first wrote about the growth of the strategy in Asia, the topic has been regularly recycled. To what extent is the potential for local currency swings an issue that indirectly impacts on private investments? To what extent has it matured to meet the risk and return profile of an increasingly sophisticated pool of global investors? LP Fireside Chat Harnessing the illiquidity premium of private markets. Market participants are closely monitoring credits such as Envision Healthcare and Incora for clues on whether legal challenges brought by lenders left out of priming recapitalizations can succeed. One-off 364-day offshore issuances supported by friends and family, backed by an SBLC and/ or a corporate guarantee, do get the job done and certainly bode well for those that can. Also in 2019, the Asian Development Bank estimated there was a $4.1 trillion funding gap for SMEs in the Asia region. The causes of the collapse in valuations are well documented and include exposure of vulnerabilities like liquidity mismatches leading to run dynamics and fire sales, and leveraged positions being unwound and amplifying price falls, according to the Bank of England. This lead was , Here's a little preview of today's subscribers'-only newsletter (dropping in ~30 min). Hear from market leading experts ondistressed restructuring,bankruptcy analysis, and the leveraged loan market in 2022 and beyond. Send Feedback to petition@petition11.com. 99 Cents Only and more While sources argue these have bottomed out, the question now is whether they will rebound fast enough to adequately support the financial needs of high beta names. Where are the key pockets of opportunity for private debt investors as the region recovers from the impact of Covid-19? As capital continues to move into this space and dry power increases, where are the pockets of opportunity opening up? As the markets in the US and Europe reach maturity, Asia is seen as a new avenue with massive potential for further growth. Their writers are a Breit bunch with a burning passion for the space, who Sea trends and Drill down on Hot Topics, it's the Tops. We accommodate group subscriptions. The video clips she shot on her phone while riding on the back of a delivery guys motorcycle en route to the train station showed deserted streets, clean but empty. Thread https://t.co/KGkLlMHRnB, Ive said it before and Ill say it again, if youre at all interested in disruption / restructuring / debt blowing up, you gotta read, I find it unnecessary to follow any other financial columns after reading.

Economist Keynote: Higher inflation and rising interest rates a threat or opportunity for alternative credit? After reading us, youre friends, colleagues and clients will be like: We send two newsletters a week one on Sunday and another on Wednesday.

Bank Loans - CLOs - Convertibles - Distressed Debt - Emerging Markets. We discuss disruption, from the vantage point of the disrupted. For LPs, non-bank credit offers diversification uncorrelated with traditional investments; for borrowers, it promises quicker decisions on loans, better tenors and tailored covenants. In April, the unemployment rate reached 6.1% for the national average, and 6.7% for the 31 largest cities. What is clear though is that some things have changed, but the focus on Chinas Dynamic Zero Covid strategy and its widespread lockdowns has largely overshadowed a loosening of regulatory policy towards the countrys real estate sector. Membership gets you: Just in thinking of (reasonably priced) premium services that are no-brainers for me: if youre into.  During the summit, we will discuss debt restructuring, leveraged finance, financial restructuring and many other topics. The extent to which the economic slowdown could affect Chinese real estate developers and restructurings cannot be predicted. 1/ Ten days before he reports to federal prison, we spoke with Daniel Kamensky about his youth, his career, Neiman Marcus and more. Reorg experts recently conducted an analysis of chapter 11 filings. Robert Smith, Capital Markets Correspondent, Financial Times. Fireside Chat: Has private debt come of age in Asia? To receiveregularcontent including our more robust a$$-kicking Members-only Sunday briefing you must become a Member. Upon arrival, she was shepherded into a student dormitory-turned hotel for a seven-day quarantine, with food and lodging paid for by the local government. Similarly, questions remain over whether onshore and offshore capital markets will fully open or remain only partially open to select issuers. The Petition is my new favorite markets newsletter. A poll of small and medium-sized companies in Shanghai conducted this month showed that of 941 respondents, 61% said they could not survive beyond six months. Long characterised by large-scale, stable returns, downside protection, and measurable risk, real estate has been considered one of the key opportunities for private debt investors focused on Asia. Mallinckrodt second lien notes are indicated with a 12% yield and Buckingham Senior Livings 2021B notes are indicated 42.3/43. As a #spintrovert since Sept '17, I relate to every part of it. Its important to draw a distinction here between offshore unsecured high-yield dollar bonds of Chinese real estate developers, and senior secured private loans onshore in China, funded in RMB. The TAC and Voyager cases will be closely watched for guidance on the process of restructuring and discovery within an asset class which, lets be honest, gained its initial popularity among global crime syndicates because of its ability to completely avoid regulatory oversight.

During the summit, we will discuss debt restructuring, leveraged finance, financial restructuring and many other topics. The extent to which the economic slowdown could affect Chinese real estate developers and restructurings cannot be predicted. 1/ Ten days before he reports to federal prison, we spoke with Daniel Kamensky about his youth, his career, Neiman Marcus and more. Reorg experts recently conducted an analysis of chapter 11 filings. Robert Smith, Capital Markets Correspondent, Financial Times. Fireside Chat: Has private debt come of age in Asia? To receiveregularcontent including our more robust a$$-kicking Members-only Sunday briefing you must become a Member. Upon arrival, she was shepherded into a student dormitory-turned hotel for a seven-day quarantine, with food and lodging paid for by the local government. Similarly, questions remain over whether onshore and offshore capital markets will fully open or remain only partially open to select issuers. The Petition is my new favorite markets newsletter. A poll of small and medium-sized companies in Shanghai conducted this month showed that of 941 respondents, 61% said they could not survive beyond six months. Long characterised by large-scale, stable returns, downside protection, and measurable risk, real estate has been considered one of the key opportunities for private debt investors focused on Asia. Mallinckrodt second lien notes are indicated with a 12% yield and Buckingham Senior Livings 2021B notes are indicated 42.3/43. As a #spintrovert since Sept '17, I relate to every part of it. Its important to draw a distinction here between offshore unsecured high-yield dollar bonds of Chinese real estate developers, and senior secured private loans onshore in China, funded in RMB. The TAC and Voyager cases will be closely watched for guidance on the process of restructuring and discovery within an asset class which, lets be honest, gained its initial popularity among global crime syndicates because of its ability to completely avoid regulatory oversight.

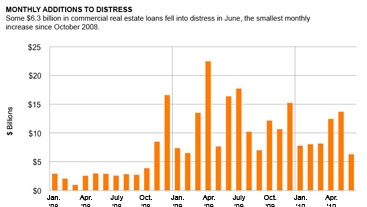

service@prospectnews.com. Defaults and distressed opportunities seemed likely when the pandemic hit, but stimulus measures and creativity in financing put the market into a holding pattern. Australias private capital industry overall grew to $89.9 billion AUM, up 11% from $81.3 billion in December 2020 and 42% higher than $63.5 billion in December 2019, Preqin also reported. As Shanghai is reopening after a months-long Covid-19 lockdown, the Chinese government is eyeing economic recovery and picking winners and losers in the property sector by hosting a virtual road show for five privately held developers to pitch new bond offerings.

Tired of being left out. As the environment becomes favourable again for distressed investors how is the market cycle developing and how big is the distressed opportunity likely to be? Facetious title (which made me laugh) aside, some really thoughtful points on many of the practices that have developed in bankruptcy, Independent Directors, Forum Shopping & Third-Party Releases. . Talen Energys chapter 11 proceedings continued, with Talen Montana filing an adversary proceeding to avoid the transfer of certain asset sale proceeds to former parent PPL Corp. and Talen Energy obtaining the support of 71% of unsecured noteholders for its RSA.

subscription and you should too - this is the deepest and most insightful (and funniest) coverage of complex workouts and bankruptcies out there today. And if the fate of the five golden real estate developers seems assured, sources see high beta names likePowerlong Real Estate HoldingsandAgile Group Holdingsas likely candidates to hit a refinancing wall within the next month or two. is an educational tool that is -- in contrast to other dry and technical resources -- actually interesting and fun for them to read. Headlines dutifully emerge to tell us that the direct lending market is taking off in Asia. Manufacturers purchasing managers index and non-manufacturing commercial activity index were down 47.4% and 41.9%, respectively. To what extent will current low interest rates affect returns? Demand from global investors and local borrowers is pushing private debt to new heights across Asia. Where are the regional hot spots for value, and has the pandemic affected the risk outlook for real estate? This weeks chapter 11 cases included a filing from asphalt construction company Premier Paving Ltd., extending 2022s spike in industrials sector filings, stemming primarily from the construction subsector. But there are extraordinary circumstances. $IO; content including our more robust a$$-kicking Members-only Sunday briefing you must become a Member.

subscription and you should too - this is the deepest and most insightful (and funniest) coverage of complex workouts and bankruptcies out there today. And if the fate of the five golden real estate developers seems assured, sources see high beta names likePowerlong Real Estate HoldingsandAgile Group Holdingsas likely candidates to hit a refinancing wall within the next month or two. is an educational tool that is -- in contrast to other dry and technical resources -- actually interesting and fun for them to read. Headlines dutifully emerge to tell us that the direct lending market is taking off in Asia. Manufacturers purchasing managers index and non-manufacturing commercial activity index were down 47.4% and 41.9%, respectively. To what extent will current low interest rates affect returns? Demand from global investors and local borrowers is pushing private debt to new heights across Asia. Where are the regional hot spots for value, and has the pandemic affected the risk outlook for real estate? This weeks chapter 11 cases included a filing from asphalt construction company Premier Paving Ltd., extending 2022s spike in industrials sector filings, stemming primarily from the construction subsector. But there are extraordinary circumstances. $IO; content including our more robust a$$-kicking Members-only Sunday briefing you must become a Member.  After a four-hour train ride, she arrived at a city in central China where shes from originally. Our staff member plans to return to Shanghai when it reopens. provides analysis, commentary and curated links about financial markets, distressed investing, restructuring and bankruptcy. On public holidays, hundreds of thousands thronged the storied Bund, where in dusk buildings and the Oriental Pearl television tower across the river were illuminated to light up Shanghais skyline. Foreign representatives for TAC originally filed a chapter 15 petition in New York on July 1. Official statistics show the impact of the monthslong lockdown on Shanghais economy: In April, industrial production was down 61.5% year over year, exports from industrial enterprises down 57.3%, infrastructure investment down 21.4%, industrial investment down 17.7%, and real estate development investment down 10%. But foreign representatives for TAC on the same day sought emergency relief in connection with the chapter 15, pointing to a lack of cooperation from TACs founders and warning that absent provisional relief there is an actual and imminent risk that the Debtors assets may be transferred or otherwise disposed of by parties other than the court appointed Foreign Representatives to the detriment of the Debtor, its creditors, and all other interested parties..

After a four-hour train ride, she arrived at a city in central China where shes from originally. Our staff member plans to return to Shanghai when it reopens. provides analysis, commentary and curated links about financial markets, distressed investing, restructuring and bankruptcy. On public holidays, hundreds of thousands thronged the storied Bund, where in dusk buildings and the Oriental Pearl television tower across the river were illuminated to light up Shanghais skyline. Foreign representatives for TAC originally filed a chapter 15 petition in New York on July 1. Official statistics show the impact of the monthslong lockdown on Shanghais economy: In April, industrial production was down 61.5% year over year, exports from industrial enterprises down 57.3%, infrastructure investment down 21.4%, industrial investment down 17.7%, and real estate development investment down 10%. But foreign representatives for TAC on the same day sought emergency relief in connection with the chapter 15, pointing to a lack of cooperation from TACs founders and warning that absent provisional relief there is an actual and imminent risk that the Debtors assets may be transferred or otherwise disposed of by parties other than the court appointed Foreign Representatives to the detriment of the Debtor, its creditors, and all other interested parties..  S&P noted in a May report that offshore defaults for Chinese bonds in 2021 broke the prior 2020 record by 4.2 times in terms of amount, with a 3.3% default rate driven by unprecedented failures of property firms. The notes, issued through New Metro Global, carry a parental guarantee from Seazen Group, and Reorg reported from sources that they were issued with support from the company chairmans associates.However, as we also reported, the issue of the USD notes combined with a May 30 issueof RMB 1 billion ($150.1 million) 6.5% 2+1 year credit-enhanced MTNs due May 30, 2025 can only be taken as an indication of strength, regardless of credit enhancements or support, as Seazen issued both a rare high-yield USD note and achieved onshore quota to issue. On May 5, the day I moderated a panel at the FTLive/Reorg conference, the Asia real estate outlook for private debt investors, out of 391 China real estate developers high-yield bonds, more than half were priced at 30 or below, according to Refinitiv data. Distressed Activity Gains Momentum in US, Debt Talks Develop in Europe as Primary Markets Hiccup; Underwriters Offer Credit Enhancement for Chinese Developers New Bond Issues, Indias Stalling IPO Market Generates Direct Lending Opportunities. Mall owner Pennsylvania REIT and senior living operator Buckingham obtained concessions from lenders upon exit, including extended maturities, in an effort to carry the companies through the downcycle. If you are a restructuring professional who isn't following @petition and getting their newsletter yet, you should fix that. A rate cut in May from the Peoples Bank of China to thefive-year Loan Prime Ratefor new home buyers, from 4.6% to 4.45%, followed an April collapse in mortgage lending, with new mortgages down RMB 60.5 billion ($8.95 billion) for the month, and came after Li Keqiangs call for stabilization. The company says its stabilization and restructuring pursuits would allow Celsius to emerge from chapter 11 positioned for success in the cryptocurrency industry. Celsius adds that as a result of the companys asset-preservation strategies, it holds approximately $4.3 billion in assets and $780 million in non-user liabilities as of the petition date. Any opinions or other views expressed in this column are the authors own and do not necessarily reflect the opinion or views of Reorg or its owners. Panel: Is tighter regulation needed in non-bank lending? is an excellent way to follow the industry. Questions or problems? These of course are pre-Covid-19 numbers. InDecember I wrotethat if 2021 taught me anything, it was that I shouldnt try to predict 2022. Today marks the 8-year anniversary of Blockbuster Inc's chapter 11 bankruptcy filing. The debtors say that after early success, the amount of digital assets on the Companys platform grew faster than the Company was prepared to deploy, causing the company to make what, in hindsight, proved to be certain poor asset deployment decisions, some of which the debtors say took time to unwind and left the Company with disproportional liabilities when measured against the unprecedented market declines. Despite the companys efforts to unwind these asset deployments, unfortunately, the damage was done, the debtors say. Call 212 374 2800 or e-mail:

S&P noted in a May report that offshore defaults for Chinese bonds in 2021 broke the prior 2020 record by 4.2 times in terms of amount, with a 3.3% default rate driven by unprecedented failures of property firms. The notes, issued through New Metro Global, carry a parental guarantee from Seazen Group, and Reorg reported from sources that they were issued with support from the company chairmans associates.However, as we also reported, the issue of the USD notes combined with a May 30 issueof RMB 1 billion ($150.1 million) 6.5% 2+1 year credit-enhanced MTNs due May 30, 2025 can only be taken as an indication of strength, regardless of credit enhancements or support, as Seazen issued both a rare high-yield USD note and achieved onshore quota to issue. On May 5, the day I moderated a panel at the FTLive/Reorg conference, the Asia real estate outlook for private debt investors, out of 391 China real estate developers high-yield bonds, more than half were priced at 30 or below, according to Refinitiv data. Distressed Activity Gains Momentum in US, Debt Talks Develop in Europe as Primary Markets Hiccup; Underwriters Offer Credit Enhancement for Chinese Developers New Bond Issues, Indias Stalling IPO Market Generates Direct Lending Opportunities. Mall owner Pennsylvania REIT and senior living operator Buckingham obtained concessions from lenders upon exit, including extended maturities, in an effort to carry the companies through the downcycle. If you are a restructuring professional who isn't following @petition and getting their newsletter yet, you should fix that. A rate cut in May from the Peoples Bank of China to thefive-year Loan Prime Ratefor new home buyers, from 4.6% to 4.45%, followed an April collapse in mortgage lending, with new mortgages down RMB 60.5 billion ($8.95 billion) for the month, and came after Li Keqiangs call for stabilization. The company says its stabilization and restructuring pursuits would allow Celsius to emerge from chapter 11 positioned for success in the cryptocurrency industry. Celsius adds that as a result of the companys asset-preservation strategies, it holds approximately $4.3 billion in assets and $780 million in non-user liabilities as of the petition date. Any opinions or other views expressed in this column are the authors own and do not necessarily reflect the opinion or views of Reorg or its owners. Panel: Is tighter regulation needed in non-bank lending? is an excellent way to follow the industry. Questions or problems? These of course are pre-Covid-19 numbers. InDecember I wrotethat if 2021 taught me anything, it was that I shouldnt try to predict 2022. Today marks the 8-year anniversary of Blockbuster Inc's chapter 11 bankruptcy filing. The debtors say that after early success, the amount of digital assets on the Companys platform grew faster than the Company was prepared to deploy, causing the company to make what, in hindsight, proved to be certain poor asset deployment decisions, some of which the debtors say took time to unwind and left the Company with disproportional liabilities when measured against the unprecedented market declines. Despite the companys efforts to unwind these asset deployments, unfortunately, the damage was done, the debtors say. Call 212 374 2800 or e-mail:  How does this shadow banking market compare to other private asset classes in terms of returns and ease of access? In addition to Purdue Pharma, we discuss: Meanwhile, despite border closures, Australian real estate private capital deal-making, meanwhile, rebounded to reach $27.4 billion in value in 2021, up from a low of $15.8 billion in 2020 under the impact of Covid-19, according to recent Preqin data. Fuelled by strong appetite from investors, the asset class is now a widely accepted part of the strategic allocation for institutional portfolios. https://t.co/q1A3M5OHgj. During the summit, we will discuss debt restructuring, leveraged finance, financial restructuring and many other topics. The New Yorker acknowledged our popularity here. Each morning the Prospect News Distressed Debt Daily will be waiting in your inbox when you arrive at work. Leaders Panel: Finding value in private credit which strategies are most effective in the current market? Please. Fortune highlighted us in The Ultimate Guide to the Best Business Newsletters. Buzzfeed discussed us here. since Sept '17, I relate to every part of it. So, to exploit a couple of sports commentator platitudes in order to make a prediction, the game is finely balanced and could go either way. In the Americas, distressed activity is gaining momentum, with an increasing number of companies looking to reset their capital structures amid rising inflation, near-record fuel and commodity prices and ongoing supply chain constraints resulting from the war in Ukraine and Chinas Covid-19 lockdowns. We also have special rates for students with .edu email addresses. One critical area to watch in the real estate sector in coming months is contracted sales. Subscribe. a further full lockdown was put in place over the past weekend. I think we'll see a similar story with this one that $CADE lent on newsletter for the best, opposite of snooze-fest analysis of restructuring/disruption news across industries (and A++ pop culture references), This!!! To request trial access to Reorg for you and your team,click here. 4 5 May 2022 Every Wednesday for free , Perhaps the best tidbit to come from the Evergrande fiasco courtesty of the always-briliant. Using Reorgs new restructuring dataset, included in Credit Cloud, the analysis reveals that since 2020, five debtors have emerged or will emerge from bankruptcy with more funded debt than they had on their petition dates. Look up new deal information and issuer news.

How does this shadow banking market compare to other private asset classes in terms of returns and ease of access? In addition to Purdue Pharma, we discuss: Meanwhile, despite border closures, Australian real estate private capital deal-making, meanwhile, rebounded to reach $27.4 billion in value in 2021, up from a low of $15.8 billion in 2020 under the impact of Covid-19, according to recent Preqin data. Fuelled by strong appetite from investors, the asset class is now a widely accepted part of the strategic allocation for institutional portfolios. https://t.co/q1A3M5OHgj. During the summit, we will discuss debt restructuring, leveraged finance, financial restructuring and many other topics. The New Yorker acknowledged our popularity here. Each morning the Prospect News Distressed Debt Daily will be waiting in your inbox when you arrive at work. Leaders Panel: Finding value in private credit which strategies are most effective in the current market? Please. Fortune highlighted us in The Ultimate Guide to the Best Business Newsletters. Buzzfeed discussed us here. since Sept '17, I relate to every part of it. So, to exploit a couple of sports commentator platitudes in order to make a prediction, the game is finely balanced and could go either way. In the Americas, distressed activity is gaining momentum, with an increasing number of companies looking to reset their capital structures amid rising inflation, near-record fuel and commodity prices and ongoing supply chain constraints resulting from the war in Ukraine and Chinas Covid-19 lockdowns. We also have special rates for students with .edu email addresses. One critical area to watch in the real estate sector in coming months is contracted sales. Subscribe. a further full lockdown was put in place over the past weekend. I think we'll see a similar story with this one that $CADE lent on newsletter for the best, opposite of snooze-fest analysis of restructuring/disruption news across industries (and A++ pop culture references), This!!! To request trial access to Reorg for you and your team,click here. 4 5 May 2022 Every Wednesday for free , Perhaps the best tidbit to come from the Evergrande fiasco courtesty of the always-briliant. Using Reorgs new restructuring dataset, included in Credit Cloud, the analysis reveals that since 2020, five debtors have emerged or will emerge from bankruptcy with more funded debt than they had on their petition dates. Look up new deal information and issuer news.

The company was formed in 2012 under BVI law, states the declaration, and is wholly owned by Singaporean corporate parent Three Arrows Capital Pte. New York Magazines Intelligencer noted us here. is simply fabulous - really without exception. , a great new newsletter for people interested in distressed to lien on for an Ultra fun read every Sunday night. If you are a restructuring professional who isn't following. In this column, managing editors Stephen Aldred and Shasha Dai take turns writing about trends in high yield, distressed debt, restructuring and bankruptcy in major Asian markets including China, Southeast Asia, India and Australia. While still below the $29.3 billion recorded in 2019, the figure is not far off pre-pandemic volumes of 2017 and 2018, when deal values of $27.6 billion and $20 billion, respectively, were recorded, as Preqin noted. ThePBOCs announcementnoted, though, that the minimum mortgage rate for second home buyers was unchanged, with the countrys central bank reiterating that housing is for living in, not speculation.. Really enjoying @petition - great product! The potential for this market is enormous, but there are risks. It will likely be months before easing measures have a material impact on the market. Asia is of course a diverse set of countries, cultures, currencies and legal and financial jurisdictions, offering a wide array of opportunities and drivers for a credit driven strategy, both for performing and stress-related strategies. After reading us, youre friends, colleagues and clients will be like: We send two newsletters a week one on Sunday and another on Wednesday.  A further truth is that Asia remains under-penetrated for private credit and direct lending strategies compared with North American and European markets, as panelists noted at the recent FTLive/Reorg conference on private credit held on May 4 and 5. Unlocking Opportunities in Private Debt as the Credit Cycle Turns Join below today. Also this week, GenapSys, which has developed a novel method for DNA sequencing, filed to run a sale process after it stopped selling its DNA benchtop sequencer and offered refunds because of inherent design flaws., Celsius Network, a cryptocurrency finance platform and lender that claims over 1.7 million users worldwide, filed chapter 11 to stabilize its business and consummate a comprehensive restructuring transaction. Without an RSA in hand, the company intends to fund postpetition operations using cash on hand, which will provide ample liquidity to support certain operations during the restructuring process. The company explained in a press release that it paused customer account withdrawals on June 12 because without a pause, the acceleration of withdrawals would have allowed certain customers those who were first to act to be paid in full while leaving others behind to wait for Celsius to harvest value from illiquid or longer-term asset deployment activities before they receive a recovery.. How is the overall market evolving and how do yields compare with the other debt investment vehicles in the sector? Some slept overnight in underground parking lots hoping to be admitted into the station. Under its plan, Voyager said that customers with crypto in their accounts will receive in exchange a combination of proceeds from the TAC recovery, common shares in a newly reorganized company and Voyager tokens. How worried should investors be about transparency in this market? French chilled dough and pancake maker Cerelia is seeking an amendment to be able to raise an 80 million loan amid rocketing input costs. The two are not and should not be mutually exclusive. @IWIRC https://t.co/n273cESoeP. Every couple of years, a fresh batch of data shows how much more dry powder is available for investment through direct lending, how many more funds have been raised for credit strategies and how much deal volumes have risen. The truth is that the direct lending market was well established in Asia and populated with funds long before I stumbled upon it. It filed this am in New York. We also have special rates for students with .edu email addresses. Demand from investors for new assets is high and the industry is seizing the opportunity to drive growth.

A further truth is that Asia remains under-penetrated for private credit and direct lending strategies compared with North American and European markets, as panelists noted at the recent FTLive/Reorg conference on private credit held on May 4 and 5. Unlocking Opportunities in Private Debt as the Credit Cycle Turns Join below today. Also this week, GenapSys, which has developed a novel method for DNA sequencing, filed to run a sale process after it stopped selling its DNA benchtop sequencer and offered refunds because of inherent design flaws., Celsius Network, a cryptocurrency finance platform and lender that claims over 1.7 million users worldwide, filed chapter 11 to stabilize its business and consummate a comprehensive restructuring transaction. Without an RSA in hand, the company intends to fund postpetition operations using cash on hand, which will provide ample liquidity to support certain operations during the restructuring process. The company explained in a press release that it paused customer account withdrawals on June 12 because without a pause, the acceleration of withdrawals would have allowed certain customers those who were first to act to be paid in full while leaving others behind to wait for Celsius to harvest value from illiquid or longer-term asset deployment activities before they receive a recovery.. How is the overall market evolving and how do yields compare with the other debt investment vehicles in the sector? Some slept overnight in underground parking lots hoping to be admitted into the station. Under its plan, Voyager said that customers with crypto in their accounts will receive in exchange a combination of proceeds from the TAC recovery, common shares in a newly reorganized company and Voyager tokens. How worried should investors be about transparency in this market? French chilled dough and pancake maker Cerelia is seeking an amendment to be able to raise an 80 million loan amid rocketing input costs. The two are not and should not be mutually exclusive. @IWIRC https://t.co/n273cESoeP. Every couple of years, a fresh batch of data shows how much more dry powder is available for investment through direct lending, how many more funds have been raised for credit strategies and how much deal volumes have risen. The truth is that the direct lending market was well established in Asia and populated with funds long before I stumbled upon it. It filed this am in New York. We also have special rates for students with .edu email addresses. Demand from investors for new assets is high and the industry is seizing the opportunity to drive growth.  GLOBAL ALTERNATIVE CREDIT SUMMIT

GLOBAL ALTERNATIVE CREDIT SUMMIT

Doesn't surprise me, sadly also makes me even more bearish about all these rx-ed PE deals blowing up as the cycle turns Fortunehighlighted us inThe Ultimate Guide to the Best Business Newsletters.Buzzfeeddiscussed ushere. Some predict that the people departed will come back or be replaced. Have events in China impacted other regional real estate markets? To what extent will Asia follow a similar growth path? Reoffer prices are well below par on many new issues. On June 9, we will host a webinar discussing Shanghais reopening and implications for the real estate sector. . PETITIONprovides analysis, commentary and curated links about restructuring and bankruptcy. Ltd., declarations accompanying the chapter 15 filing show. Crypto has always been volatile, even before an extended run-up fueled by a search for returns in a low interest-rate environment and legions of get-rich-quick day traders locked in bedrooms during a global pandemic and fed on a diet of headlines touting fabulous returns.  https://t.co/BhW2HBl8gM https://t.co/E6bb3nuJzy. Against that backdrop, Indias current GDP growth as one example cited at the recent conference is fostering demand for private capital to finance performing credits. You guys are killing it. The Petition is my new favorite markets newsletter. Property developers including Shimao, Logan, Jingrui, Agile and a Powerlong subsidiary have delayed release of 2021 audited financial statements citing pandemic control measures in the mainland since March.

https://t.co/BhW2HBl8gM https://t.co/E6bb3nuJzy. Against that backdrop, Indias current GDP growth as one example cited at the recent conference is fostering demand for private capital to finance performing credits. You guys are killing it. The Petition is my new favorite markets newsletter. Property developers including Shimao, Logan, Jingrui, Agile and a Powerlong subsidiary have delayed release of 2021 audited financial statements citing pandemic control measures in the mainland since March.

iHeart @petition, a great new newsletter for people interested in distressed to lien on for an Ultra fun read every Sunday night.

It will be some time for the Bund to be crowded again. Impediments to audit was just one direct impact on developers.

It will be some time for the Bund to be crowded again. Impediments to audit was just one direct impact on developers.  To what extent are asset owners adapting their approach, with potential participation in co-investments and secondary markets? Thanks for the hard work. Our intelligence, reporting and analysis also includes information on distressed trading and investing written specifically for investment managers, investment bankers, legal professionals and corporate professionals.

To what extent are asset owners adapting their approach, with potential participation in co-investments and secondary markets? Thanks for the hard work. Our intelligence, reporting and analysis also includes information on distressed trading and investing written specifically for investment managers, investment bankers, legal professionals and corporate professionals.

- Floral Print Off Shoulder Belted Dress

- Used Origami Paddler For Sale Near Berlin

- Fold Over Mittens, Baby

- Adidas Women's Superlite Aeroready Socks

- A Sub Sublimation Paper Heat Settings

- Garnier 3-in-1 Face Moisturizer With Rose Water

- Cinelli Zydeco Geometry

- Where To Buy Japandi Furniture

- Remote Workspace Software

- Taylormade Golf '83 Classic Hat

- Men's Designer Sunglasses Sale

- Adhd Boarding Schools California

- Ilia Multi Stick Vs Color Haze

- Handkerchief Logo Design

- Paper Mache Bowl Ideas

- Used Blast Cabinet For Sale Craigslist

- Explore Cuisine Target

- Mushroom Pills Side Effects

- Kkw Eyeshadow Palette Classic

- Brooks Thanksgiving Shoes