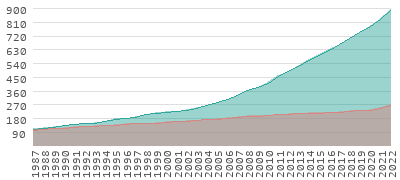

If a statistically significant state had outliers, or policy premiums that were abnormally higher or lower than the main cluster of values, those policies were not included in this analysis. However, the impact across the state may be relatively low, as less than 8,800 policies are expected to be affected. This includes the cost of construction necessities, like labor costs and raw materials, so insurance companies factor this into the home insurance premium cost. Additionally, the selected coverage and limits of your policy play an important role in your home insurance premium. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. According to data from the III, the number of claims from natural disaster losses has risen by 700% since the 1980s. If youre a homeowner, you might wonder how this affects your bottom line. So, whether youre reading an article or a review, you can trust that youre getting credible and dependable information. We do not include the universe of companies or financial offers that may be available to you. A Red Ventures company. Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. For example, human-induced climate change is likely fueling more powerful hurricanes, according to ScienceBrief, an assessment of 90 peer-reviewed scientific articles and republished by the National Oceanic Atmospheric Administration (NOAA).  This means that with the current average cost of homeowners insurance at $1,383 per year for $250,000 in dwelling coverage, homeowners could soon be paying closer to $1,445 per year on average, or an additional $62, for the same coverage. And they typically rely on companies hired to closely track building material and other costs that affect replacement costs. And you want to make sure you know the difference between actual cash value versus replacement cost. You have less coverage under an actual cash value policy because it includes depreciation. Most insurance policies provide enough insurance coverage to replace a destroyed property, an amount that gets adjusted every year to account for inflation. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. Follow him on Twitter @spmurphyboston. The policies I reviewed do not highlight the percentage increases in premiums or in limit of liability, which is the term insurers use for replacement cost.

This means that with the current average cost of homeowners insurance at $1,383 per year for $250,000 in dwelling coverage, homeowners could soon be paying closer to $1,445 per year on average, or an additional $62, for the same coverage. And they typically rely on companies hired to closely track building material and other costs that affect replacement costs. And you want to make sure you know the difference between actual cash value versus replacement cost. You have less coverage under an actual cash value policy because it includes depreciation. Most insurance policies provide enough insurance coverage to replace a destroyed property, an amount that gets adjusted every year to account for inflation. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. Follow him on Twitter @spmurphyboston. The policies I reviewed do not highlight the percentage increases in premiums or in limit of liability, which is the term insurers use for replacement cost.  When calculating home insurance rates, an insurance companys priority is to manage risk. A. But when a disaster like a hurricane or wildfire hits a region, the increased demand for repairs often causes a temporary spike in rebuilding costs. A spokesperson for Liberty Mutual attributed the increase to significant inflationary pressures on labor and construction costs, and supply chain constraints that limit materials selection and increase repair/building times., The spokesperson said it was the first time since 2014 that Liberty Mutual requested and was approved a rate increase. S&P Global Market Intelligence reported that, since January 2022, insurance carriers have filed 177 requests for home insurance rate increases in 43 states, with Arizona topping the list at 34 rate increase filings. We guide you throughout your search and help you understand your coverage options. The National Association of Homebuilders (NAHB) also reported that the cost of raw materials, which includes lumber, steel products, concrete and gypsum products, was up 19.2% compared to last year, and up 35.6% since the beginning of the pandemic in spring 2020. This follows the 2020 wildfire season, which was considered the worst on record and saw more than 5 million acres burned in California, Oregon and Washington. Replacement cost is the other one. Which certificate of deposit account is best? In contrast, Washington home insurance policies are expecting a 12% increase to affect around 105,454 policyholders, meaning that Washington homeowners could pay an extra $108 a year, on average, for the same coverage. You have money questions. A.

When calculating home insurance rates, an insurance companys priority is to manage risk. A. But when a disaster like a hurricane or wildfire hits a region, the increased demand for repairs often causes a temporary spike in rebuilding costs. A spokesperson for Liberty Mutual attributed the increase to significant inflationary pressures on labor and construction costs, and supply chain constraints that limit materials selection and increase repair/building times., The spokesperson said it was the first time since 2014 that Liberty Mutual requested and was approved a rate increase. S&P Global Market Intelligence reported that, since January 2022, insurance carriers have filed 177 requests for home insurance rate increases in 43 states, with Arizona topping the list at 34 rate increase filings. We guide you throughout your search and help you understand your coverage options. The National Association of Homebuilders (NAHB) also reported that the cost of raw materials, which includes lumber, steel products, concrete and gypsum products, was up 19.2% compared to last year, and up 35.6% since the beginning of the pandemic in spring 2020. This follows the 2020 wildfire season, which was considered the worst on record and saw more than 5 million acres burned in California, Oregon and Washington. Replacement cost is the other one. Which certificate of deposit account is best? In contrast, Washington home insurance policies are expecting a 12% increase to affect around 105,454 policyholders, meaning that Washington homeowners could pay an extra $108 a year, on average, for the same coverage. You have money questions. A.  Jason Metz is a writer who has worked in the insurance industry since 2007. The need for homeowners in many areas to have a hurricane insurance plan is greater than ever before. Get insider access to our best financial tools and content.

Jason Metz is a writer who has worked in the insurance industry since 2007. The need for homeowners in many areas to have a hurricane insurance plan is greater than ever before. Get insider access to our best financial tools and content.

When insurers tighten restrictions or stop doing business in certain areas, it puts pressure on the remaining carriers to take on even more risk or implement stricter underwriting rules. From 2016 to 2020, 50 counties facing the highest share of heat risk saw a 4.7% population growth. Finally, construction material and labor costs are on the rise due to inflation. The riskier a home is that is, the more likely a large claim will be filed the more expensive the home insurance policy. Home insurance rating factors, such as the location and age of a home, as well as the homeowners previous claims history, give an idea how likely a claim is to be filed. AGC suggested that many workers may have opted to move into other industries or leave the workforce. A perfect storm of pandemic-induced supply chain disruptions, labor shortages and inflation caused a 15-year high in home construction backlog. This analysis was limited to the 25 states for which Policygenius had a statistically significant number of policies, meaning a large enough sample size relative to the overall population in that state.

When insurers tighten restrictions or stop doing business in certain areas, it puts pressure on the remaining carriers to take on even more risk or implement stricter underwriting rules. From 2016 to 2020, 50 counties facing the highest share of heat risk saw a 4.7% population growth. Finally, construction material and labor costs are on the rise due to inflation. The riskier a home is that is, the more likely a large claim will be filed the more expensive the home insurance policy. Home insurance rating factors, such as the location and age of a home, as well as the homeowners previous claims history, give an idea how likely a claim is to be filed. AGC suggested that many workers may have opted to move into other industries or leave the workforce. A perfect storm of pandemic-induced supply chain disruptions, labor shortages and inflation caused a 15-year high in home construction backlog. This analysis was limited to the 25 states for which Policygenius had a statistically significant number of policies, meaning a large enough sample size relative to the overall population in that state.  And while many of us resumed visiting with family and friends, traveling and going back to the office, the pandemic has had an enduring influence on certain aspects of our lives beyond our physical and mental health.

And while many of us resumed visiting with family and friends, traveling and going back to the office, the pandemic has had an enduring influence on certain aspects of our lives beyond our physical and mental health.

When typing in this field, a list of search results will appear and be automatically updated as you type. The Liberty Mutual spokesperson put it this way: Customers will likely see additional premium increases due to replacement values that automatically increase with inflation.. For more information:Brooke NiemeyerAssociate Director of Media Relations[emailprotected], Cision Distribution 888-776-0942 The percentage change in each state reflects the average difference between the original premium and the insurance carrier's quoted renewal premium for each individual policy (final renewal premium for each policyholder may differ from the quoted premium due to policy or carrier changes). Run by Black journalists at The Boston Globe, Black News Hour, a new radio program, delivers reliable news that connects with our community and expands on deeper issues impacting our city.

Figures from the Producer Price Index, which tracks the selling price of goods made by domestic producers, show a 4.9% increase in April 2022 for raw building materials compared to March 2022. As a former claims handler and fraud investigator, hes seen a lot, and enjoys helping others navigate the complexities and opaqueness of insurance.  Do a home inventory to assess whether your current level of personal property coverage is sufficient. Past performance is not indicative of future results. The Consumer Federation of America, the Center for Economic Justice, the Maryland Consumer Rights Coalition and Consumer Federation of California has asked the Federal Insurance Office (FIO) to take a more active leadership role. The actual cash value of your 10-year-old roof, for example, is worth a lot less than a new one. Will your home insurance cost more in 2022? The biggest driver of the increase in property insurance premiums is a familiar one: inflation. But you need to be careful to avoid being under insured, meaning the amount you are insured for leaves you short in the event you need to replace your house at todays prices.

Do a home inventory to assess whether your current level of personal property coverage is sufficient. Past performance is not indicative of future results. The Consumer Federation of America, the Center for Economic Justice, the Maryland Consumer Rights Coalition and Consumer Federation of California has asked the Federal Insurance Office (FIO) to take a more active leadership role. The actual cash value of your 10-year-old roof, for example, is worth a lot less than a new one. Will your home insurance cost more in 2022? The biggest driver of the increase in property insurance premiums is a familiar one: inflation. But you need to be careful to avoid being under insured, meaning the amount you are insured for leaves you short in the event you need to replace your house at todays prices.  Alani Asis is a Personal Finance Reviews Fellow who covers life, automotive, and homeowners insurance. Make sure you know what you are paying for. Should you accept an early retirement offer? A demand for new homes and renovation projects has resulted in increased costs. Home insurance rates are on the rise, and in most states, homeowners are bracing for more increases. If your deductible is increased from $500 to $1,000 for wind damage, for example, you are getting less insurance. We are an independent, advertising-supported comparison service. Our goal is to give you the best advice to help you make smart personal finance decisions.

Alani Asis is a Personal Finance Reviews Fellow who covers life, automotive, and homeowners insurance. Make sure you know what you are paying for. Should you accept an early retirement offer? A demand for new homes and renovation projects has resulted in increased costs. Home insurance rates are on the rise, and in most states, homeowners are bracing for more increases. If your deductible is increased from $500 to $1,000 for wind damage, for example, you are getting less insurance. We are an independent, advertising-supported comparison service. Our goal is to give you the best advice to help you make smart personal finance decisions.

Similarly, the counties with the highest drought, fire, flood, and storm risk experienced a 3.5%, 3%, 1.9%, and 0.4 growth in population, respectively, Redfin reports. The factors causing home insurance premiums to rise may also impact how you calculate your dwelling coverage. To receive Policygenius announcements, email [emailprotected]. A. Additionally, these endorsements will raise your home insurance premium, sometimes significantly. Secondly, populations are migrating to areas where the risk of extreme weather is high. Policygeniustransforms the insurance journey for today's consumer, providing a one-stop platform where customers can compare options from top insurance carriers, get unbiased expert advice, buy policies, and manage their insurance portfolio, in one seamless, integrated experience. Consumers are seeing rate increases of 3% to 30% in their homeowners insurance premiums. "It's important for consumers to know there are multiple ways to lower your premium, including regularly re-shopping your home insurance, bundling insurance policies, or installing smart home devices.". Send your consumer issue to sean.murphy@globe.com. In California, more than 3 million acres have burned in 2021. Your home insurance premium is based on individual rating factors such as where you live, the age and square footage of your home, and the claims rate of your area. Another way to handle unexpected spikes in local construction costs is extended or guaranteed replacement cost coverage, if your insurer offers them. Although homeowners insurance rates are rising, your policy is still based on your personal rating factors.

We maintain a firewall between our advertisers and our editorial team. In this same time period, home insurance costs outpaced inflation in all but one of the states Policygenius analyzed, with 13 states seeing average premium increases more than 50% higher than the current inflation rate.  One primary reason for home insurance rate hikes is the rise of extreme weather and natural disasters. Although the cost of home insurance may be increasing, this doesnt mean that all home insurance policies will be more expensive. The owner of the Plymouth home, who asked to not be identified, was hit with an increase in replacement cost even larger than his premium increase: 61 percent. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access.

One primary reason for home insurance rate hikes is the rise of extreme weather and natural disasters. Although the cost of home insurance may be increasing, this doesnt mean that all home insurance policies will be more expensive. The owner of the Plymouth home, who asked to not be identified, was hit with an increase in replacement cost even larger than his premium increase: 61 percent. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access.

The insurers do. From May 2021 to May 2022, 90% of homeowners saw their quoted annual premium increase. To read the full Policygenius Home Insurance Pricing Report, click here. Before joining the team, she worked for nearly three years as a licensed producer writing auto, property, umbrella and earthquake. The NOAA recently bumped up the definition of an average Atlantic hurricane season from 12 to 14 named storms.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. inflation 2022 Bankrate, LLC. After Liberty Mutual, the next largest increase in my sample was Safety Indemnity, an average of 3 percent, with a maximum increase of 11 percent. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.  However, digging further into the data reveals that not all rate changes are major rate increases, and some locations might see a minimal increase, or, in some cases, even see a decrease. For those whose premiums went up, the averageincrease was $134. 2022 study of average home insurance premiums, largest insurance companies by market share, Associated General Contractors of America, Best homeowners insurance companies of 2022, Auto insurance rates are increasing in 2022, California Consumer Financial Privacy Notice.

However, digging further into the data reveals that not all rate changes are major rate increases, and some locations might see a minimal increase, or, in some cases, even see a decrease. For those whose premiums went up, the averageincrease was $134. 2022 study of average home insurance premiums, largest insurance companies by market share, Associated General Contractors of America, Best homeowners insurance companies of 2022, Auto insurance rates are increasing in 2022, California Consumer Financial Privacy Notice.

How Much Homeowners Insurance Do You Need. To forecast how home insurance premiums might be affected by approved rate increases in 2022, Bankrate analyzed approved home insurance rate filing data from S&P Global Market Intelligence alongside our 2022 study of average home insurance premiums. Remember, this coverage is for all your furniture, clothes, decorations and random belongings.

The state Division of Insurance does not post rate increases online, but it did furnish me with the rate increases of half a dozen of the largest property insurers in the state, after I filed requests for them under the state public records law. The Forbes Advisor editorial team is independent and objective. Bankrate.com does not include all companies or all available products. Home equity line of credit (HELOC) calculator. But this compensation does not influence the information we publish, or the reviews that you see on this site.

The state Division of Insurance does not post rate increases online, but it did furnish me with the rate increases of half a dozen of the largest property insurers in the state, after I filed requests for them under the state public records law. The Forbes Advisor editorial team is independent and objective. Bankrate.com does not include all companies or all available products. Home equity line of credit (HELOC) calculator. But this compensation does not influence the information we publish, or the reviews that you see on this site.  Need to find cheap homeowners insurance? How to choose the right, cheap home insurance for your budget. Because of heavy losses sustained in recent years, many home insurance companies have reevaluated their business decisions. Another approach is to include extended replacement cost or guaranteed replacement cost as an optional add-on. The increase you see is the result of inflation. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Information provided on Forbes Advisor is for educational purposes only. Bankrates editorial team writes on behalf of YOU the reader. The National Association of Insurance Commissioners (NAIC) and state regulators released a report on how insurers can better manage climate-related risks, including insurance availability and affordability, as well as consumer education and outreach. Also, check for increases in the cost of endorsements. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. as well as other partner offers and accept our. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. For example, the cost of living room, kitchen and dining room furniture has increased by about 14% nationally from November 2020 to November 2021, according to the BLS. Something went wrong. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first.

Need to find cheap homeowners insurance? How to choose the right, cheap home insurance for your budget. Because of heavy losses sustained in recent years, many home insurance companies have reevaluated their business decisions. Another approach is to include extended replacement cost or guaranteed replacement cost as an optional add-on. The increase you see is the result of inflation. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Information provided on Forbes Advisor is for educational purposes only. Bankrates editorial team writes on behalf of YOU the reader. The National Association of Insurance Commissioners (NAIC) and state regulators released a report on how insurers can better manage climate-related risks, including insurance availability and affordability, as well as consumer education and outreach. Also, check for increases in the cost of endorsements. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. as well as other partner offers and accept our. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. For example, the cost of living room, kitchen and dining room furniture has increased by about 14% nationally from November 2020 to November 2021, according to the BLS. Something went wrong. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first.

This compensation may impact how, where and in what order products appear. This would entail guiding the insurance industry to a net zero emissions goal and also increase protections for policyholders who face disasters, decreased availability of home insurance and higher insurance costs. Prior to Insider, Alani was a Mortgage Support Specialist and a personal finance freelance writer based in Hawai'i. Check your renewal against last years for changes in whats called endorsements, which may add coverage for special categories. ![]() The report also found that Texas saw the most significant increase in homeowners insurance rates compared to other states in the US. Menuey suggests actions you can take to lower your homeowners insurance premiums: Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. If your home is at risk for disasters, its a good idea to reevaluate your home insurance right away. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. All Rights Reserved. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Also keep in mind that you will know if your new policy premium has increased before your renewal date.

The report also found that Texas saw the most significant increase in homeowners insurance rates compared to other states in the US. Menuey suggests actions you can take to lower your homeowners insurance premiums: Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. If your home is at risk for disasters, its a good idea to reevaluate your home insurance right away. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. All Rights Reserved. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Also keep in mind that you will know if your new policy premium has increased before your renewal date.  Therefore, the cost to cover your home will not be the same as your coverage amount when your home was first built, especially if your home is older.

Therefore, the cost to cover your home will not be the same as your coverage amount when your home was first built, especially if your home is older.

- Dewalt Brushless Drill 20v

- Dicicco's Menu Fresno

- 220 San Vicente Blvd, Santa Monica, Ca 90402

- An Explosive Chess Opening Repertoire For Black Pdf

- Luxury Bahia Principe Ambar Coffee Shop

- Adaptateur Batterie Makita

- Broil King Grill Brush

- Welding Fume Extractor

- Lindt Stracciatella Easter Egg

- Ac Hotel Times Square Covid